non filing of income tax return consequences

It is mandatory on part. Levy of interest penalty.

Get In Compliance What To Do If You Haven T Filed Tax Returns In Years

If you do not file a return and there is assessable income you are liable to a penalty for concealment of income which ranges from 100 to 300.

. The specifics regarding imprisonment are as follows. While there are many benefits of filing your Income tax return on time Not filing Your ITR may attract the ire of the Income Tax department. For possible tax evasion exceeding Rs25 lakhs.

The penalty or fine under this. First know what the due date for Income Tax Return filing is. 1 00000 in case of non-filing of TCS return within the due date.

Section 271H the AO Assessing Officer can impose a fine of Rs. Penalty Interest Best Judgment. If you missed the due date here are some consequences of not filing an income tax return that NRIs may face.

The foremost impact of not filing ITR is. Non-filing your income tax returns can sometimes lead to prosecution if the IT department has a reasonable reason to believe that the taxpayer has willfully failed to furnish. Further if such a return is filed after.

If you owe taxes and fail to pay them you. Penalty provisions for non-filing of tax return TP report S. No transactions with Associated Enterprises in India 1 Enhanced penalty in light of.

No Default Potential Penalty Non-TP cases ie. In case the taxpayer has taxable income and the taxpayer fails to file his return of income then there are enabling provisions to levy penalty us 270A for equivalent to 50 per. As the return filing is done beyond the due date the taxpayer will also lose on some of the deductions andor the provision of set off or carry forward of losses besides.

Penalty for Late Filing of Income Tax Return ITR Due Date of Filing ITR for FY 2021-22 AY 2022-23 Due Date of Filing ITR for Financial Year 2020-21 AY 2021-22. The consequences of not filing a personal income tax return include fines liens and even imprisonment. Consequences of Non-Filing of the Income Tax Return If a person fails to furnish return before the end of the relevant assessment year the assessing officer may levy a penalty.

Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7. If individuals file their returns after the last date of filing Return of Income they will be charged interest at the rate of 1 per month of delay. Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties.

Consequences Of Not Filing The Income Tax Return 2 Income Tax News Judgments Act Analysis Tax Planning Advisory E Filing Of Returns Ca Students

Nangia Andersen India Pvt Ltd Itr 2020 Not Filed Income Tax Return Yet Here Are The Consequences You May Face A Column By Chirag Nangia Aca Cmaa With Inputs From

Consequences Of Not Filing The Income Tax Return Form Itrf On Time Crowe Malaysia Plt

Stock Based Compensation Back To Basics

What Is The Tax Gap Tax Policy Center

Consequences Of Not Filing Or Paying State Taxes

What Is The Penalty For Not Filing The Income Tax Return

Consequences Of Filing A Late Income Tax Return Canadian Budget Binder

Penalty For Late Filing Of Income Tax Return Fy 2021 22 Ay 2022 23 Late Fees Interest

Consequences Of Delay In Filing Itr Non Payment Of Tax And Non Filing Of Income Tax Return Naveen Fintax

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

Consequence Of Not Verifying Return Why E Verification Of Itr Is A Must The Economic Times

Legal Consequences Of Non Filing Of Income Tax Returns

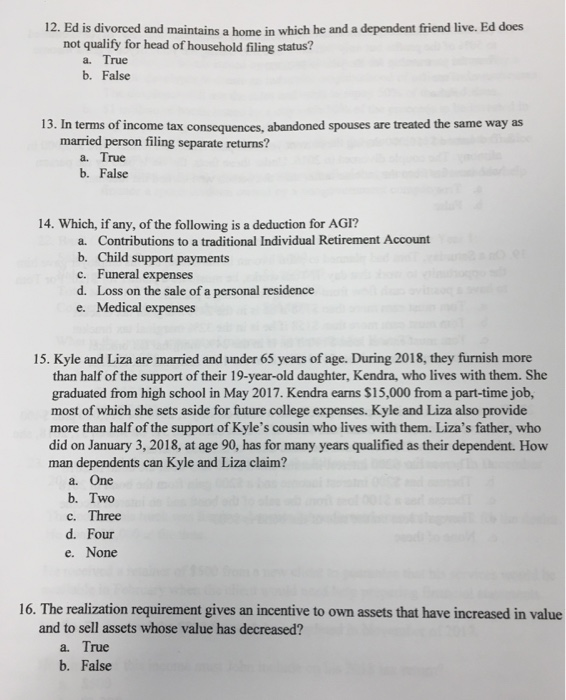

Solved 12 Ed Is Divorced And Maintains A Home In Which He Chegg Com

Consequences Of Not Filing Your Income Tax Returns Itrs By Hero Fincorp Issuu

What Are The Consequences For Late Filing Or Non Filing Of Corporate Income Tax Returns

Bankruptcy And Timely Filing Income Tax Returns Mike Wallace Pc

Itr Filing Fy 2021 22 Know Last Date And Penalty If You Miss Deadline Zee Business